Retreat Fund I

Retreat Hotels & Resorts is proud to announce it’s new Fund, Retreat Hotel Fund I LLC (the “Retreat Fund”), which is a $20 million diversified real estate Fund and is targeting a 15% Internal Rate of Return

Strong Track Record

The sponsor, Retreat Hotels & Resorts, and its predecessor, LNWA, has over 35 years of experience in hotel development, management, and ownership experience.

Curated and Diversified Offering

While most funds are “blind,” the Retreat Fund has identified exceptional investments accounting for 70% of the Fund’s capital. The Fund is diversified geographically, and across asset classes, with exposure to hospitality and residential.

Skin in the Game

Retreat and its partners have invested more than $8MM of our own capital, a display of our confidence in the Fund. We have skin in the game, and a plan to succeed.

Retreat Hotels & Resorts Team

Retreat Fund Advisory Board

Track Record

Retreat Fund I is being run by experts across hospitality and development, with an advisory board spanning industries and sectors.

Our projects are delivered on-time, on-budget, and have remained steady through economic shifts with returns in excess of 15% IRR.

Why invest now?

Hotel demand has soared.

The hotel industry experienced steady growth before COVID-19, a downturn during the pandemic, and rebounding performance thereafter.

Many analysts expected the sector would not recover to pre-pandemic levels until 2024. However, by 2022, national hotel room demand had already exceeded pre-pandemic levels. Room revenue was $189 billion in 2022, $18 billion greater than pre-pandemic levels in 2019.

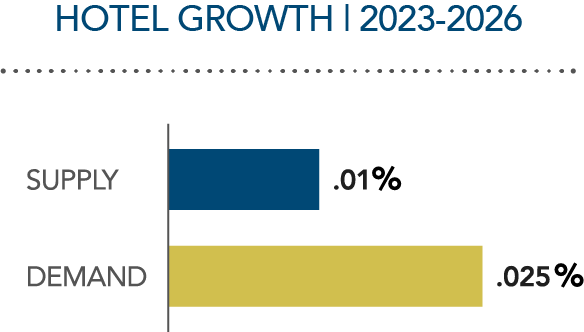

Demand is outpacing supply.

While hotel supply grew approximately 1.9% per annum from 2016 to 2019, that has dropped every year since, with supply growth of only 0.5% in 2022. This undersupply, driven by increasing interest rates and high construction costs, is expected to continue. Over the next three years, supply is projected to grow at only 1%, versus demand growth of 2.5% per annum.

Investment Terms

Minimum Investor Commitment

$50,000

Fees

Sponsor will receive an annual fee of 1.25% of committed capital. Transaction and property-level fees customarily seen in the development/hospitality industry, as further outlined in the complete offering documents.

Fund Size

$20 million to $30 million, in the form of cash or shares in assets

Fund Term

The term will be eight (8) years from the Initial Closing, subject to the discretion of the Manager for additional extensions.